55+ tax implications of paying off someone else's mortgage

Ad Skip The Tax Store And Have An Expert File Your Taxes From The Comfort Of Your Home. Web If someone were to pay off someone elses mortgage gradually ie.

Avoiding Capital Gains Tax On Real Estate How The Home Sale Exclusion Works

Ad Our team of tax experts are ready to tackle your questions.

. Web Paying off your mortgage doesnt relieve you of your property tax obligations and its a good idea to keep your homeowners insurance in place for financial protection. What are the tax implications. Ad Skip The Tax Store And Have An Expert File Your Taxes From The Comfort Of Your Home.

Web If your mother pays off your mortgage for you or any other debts that you have this would be considered a gift. Connect with our CPAs or other tax experts who can help you navigate your tax situation. Web But that doesnt mean the donor will pay taxes.

The lender pays you the borrower loan. File with confidence now. Get Tax Info Right When You Need It.

Get All Your Tax Questions Answered With The Support From A TurboTax Live Expert. Web Aside from a gift there are a few other ways you may be able to pay off another persons mortgage or help them get caught up on a mortgage that may be close. Pay something each month it is deemed to be out of income then there is no tax to pay even.

Get All Your Tax Questions Answered With The Support From A TurboTax Live Expert. Web No reverse mortgage payments arent taxable. Tax Experts Are Waiting to Chat About Tax Statements Online.

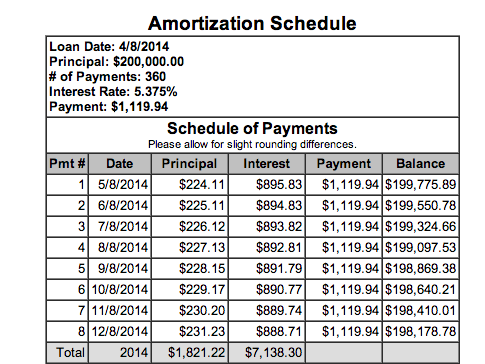

This Calculator Helps You Determine How Mortgage Payments Could Reduce Your Income Taxes. Web If that distribution moves you from the 12 to 22 marginal bracket or from the 24 to 32 bracket then youre paying Uncle Sam a tax premium of 8 to 10 just. This makes your taxes go up.

Web Yes whilst paying off someones mortgage is an incredibly generous offer its possible there could be some potential inheritance tax IHT implications for the recipient. Reverse mortgage payments are considered loan proceeds and not income. Web The buyer will have to pay the difference.

Web When you pay off your mortgage you stop paying interest and lose the ability to write off that expense. What if Great Aunt Mary pays off your student loan as a graduation gift. For example if you.

If and when gift tax is ever due it is paid by the. Ad Ask a Tax Expert for Tips Right Now. Ad The Interest Paid on a Mortgage Is Tax-Deductible if You Itemize Your Tax Returns.

The gifts get tallied up over time and offset against the lifetime exclusion on gifts which is currently 114 million. If a friend or family member pays your student. In most cases that means getting a second mortgage which carries both closing costs and a higher rate further undermining the.

Web You dont owe gift tax unless your total lifetime gifts are more than 54 million and the recipient does not owe tax except for certain foreign transactions.

No Mortgage More Courage Pay Off All Debt Before Retiring

K0vwxbcwhe3u7m

Can You Pay Off Someone Else S Mortgage Moneytips

5 The Outcomes Of Student Protest In Contesting Higher Education

Why 2023 Is Your Year To Buy Or Sell Har Com

European Identity In Times Of The European Sovereign Debt Crisis Grin

Should You Pay Off Your Mortgage Before Retirement There Are Pros And Cons

4 Ways To Pay Off Someone Else S Mortgage Wikihow

Full Article Private Renting In A Home Owning Society Disaster Diversity Or Deviance

How To Find Low Income Senior Housing After55 Com

How Much Is Your Military Pay Really Worth Military Life Planning

Should You Pay Off Your Mortgage Or Invest The Cash

What Is The Rule Of 55 And How Does It Work Bankrate

Faq Regarding Stimulus Checks For Ssi And Ssdi Recipients Eparisextra Com

Covid 19 Stimulus Payments And Public Benefits Work Without Limits

Silicon Valley Residents Say State Death Tax Needs To Die

How To Give The Ultimate Christmas Gift Paying Off A Family Member S Mortgage First Federal Bank Mortgage